Canadian Emergency Wage Subsidy: The Calculations

The hardest thing about applying for the Canadian Emergency Wage Subsidy (CEWS) Program is not the actual application, it’s the calculations…and being the daughter of a former Canada Revenue Agency manager where future ‘audit’ risk is often at the back of my mind.

The Canadian Emergency Wage Subsidy supports businesses experiencing between 30% drop in revenue compared to previous year (by relevant month) or compared to Jan and Feb 2020 revenues; an exception is the month of March where a drop in 15% of revenues deems a company eligible. The funding support equates to 75% of salary to a maximum of $847 per week per eligible employee for up to 12 weeks (March 15 to June 6 2020).

Things I found challenging:

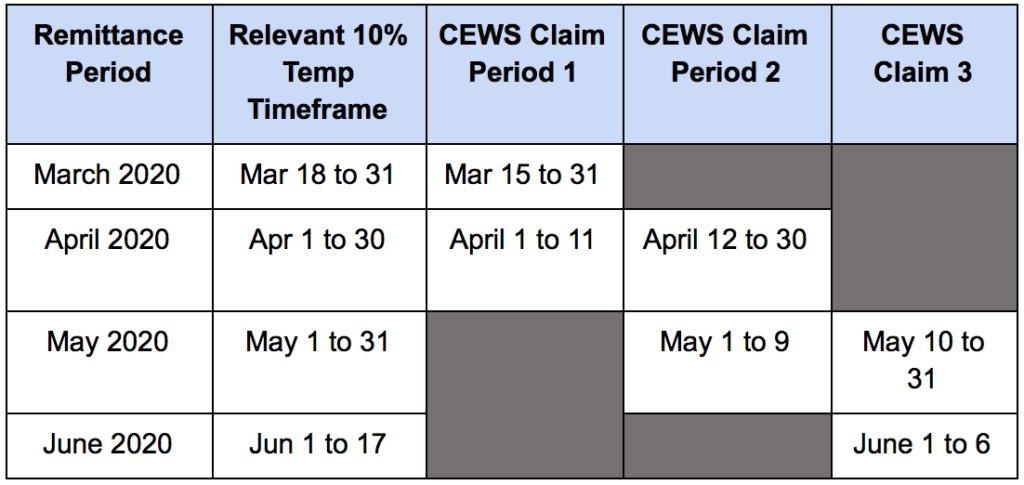

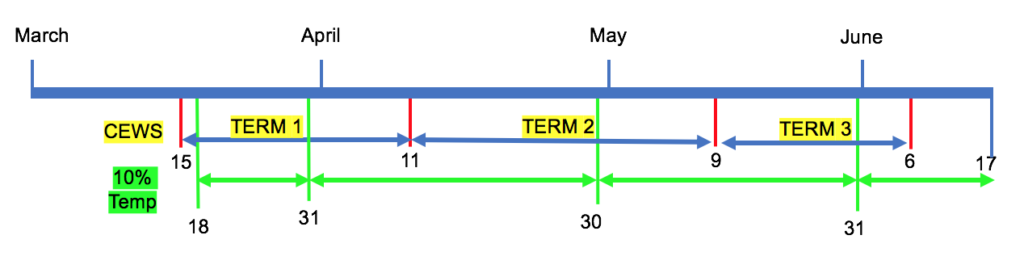

- CEWS calculations requires that you deduct the 10% Temporary Wage Subsidy(‘10% Temp’) however the complication is that there are timeline differences.

- Remittance is made on a monthly basis for the calendar month (i.e. March is March 1 to 31), but 10% Temp is only applicable for remuneration after Mar 18

- Most of my staff are on salary and one staff on hourly

- Calculations for salary staff who took time off

- I didn’t apply for the 10% Temp against my April remittance pending the launch of CEWS thinking it would be less complicated.

- I use a payroll system but because most staff are on salary, but it doesn’t run a report with actual hours worked based on the CEWS or 10% Temp timelines.

- Calculation of the 10% Temp as applied to the same Claim Period as CEWS, which is required because it is part of the CEWS calculation

There is a decent CRA CEWS Information Portal that is being updated regularly with FAQs and Application Guide. I tallied up the number of pages of reading and it’s a good 40-50 pages of reading with numbers and calculations. The FAQs alone were 17 pages.

Here’s some steps I took that may help you or drive you to getting help from your accountant. I’m not an accountant and suggest that you discuss your specific business questions with your finance team (accounting, bookkeeper, and/or payroll specialist). The assumption before you follow these steps is that you’ve checked your eligibility for the program and have the revenue data to back yourself up if probed by CRA

- I had to be really clear about calculation based on the relevant timelines.

Figure: Overlapping claim timeframes for CEWs and 10% Temp

2. A new spreadsheet was created to log each staff member’s earnings by week.

-

- Adjust eligible salaries that are monthly to weekly. VERY IMPORTANT because CEWS is for 4 weeks

- Separate staff who are making more than $1129.33 per week

- Be sure to enter eligible wages in the right sheet within the CRA Calculation spreadsheet, either as ‘Batches, ’weekly wages, or bi-weekly

Be sure to:

-

- Make adjustments to any vacation by the week (I opted to exclude these employees in the batch calculation)

- Back out any other employment grants that you may have gotten for relevant employees

3. 10% Temporary Subsidy: Remember, the way this program reads, CRA assumes, even if you didn’t do this, that you claimed the 10% Temp in your last remittance due April 15. Originally, I thought I could just take the calculation from spreadsheet (i.e. Total Payroll Issued was $30,000, so my 10% Temp = $3,000). This is actually incorrect, though it would be a heck of a lot easier.

Here’s where it gets even more challenging:

The 10% Temp maxes out on the income tax deduction of the remuneration term. So, I first calculated how much in taxes this was relevant for two terms:

-

-

- March 18 to March 31, and

- April 1 to April 11

- Then I compared the 10% Temp with taxes owed and took the lower of the two numbers for the CEWS calculation

-

There were 10,000 applications submitted this morning (April 27) already and I wonder how many of them were calculated accurately. Remember, you or your accountant is signing off on this and it is your business so ultimately, there is some responsibility on your end to say I know that this was calculated correctly. According to a call I had with CRA, there isn’t a way to adjust an application at this time. However, if there is a compliance issue, the employer must repay amounts paid under this program should they not meet eligibility requirements. Penalties for fraudulent claims are serious including fines and even imprisonment.

Am I overcomplicating things? Maybe, but I can say that I’m audit-proofing best I can. Compliance in the world of grants and government funding is crucial. Although we don’t know if CRA will do audits, as a Canadian taxpayer, I’m hoping for all our sakes that this funding will be allocated correctly and that businesses protect themselves from future potential audits. This took about 4 hours for me to wrap my head around this and just hoping that I didn’t give you a bigger headache!