Ontario Budget 2025: What It Means for Your Business (And Your Grant Strategy)

Ontario’s 2025 budget is here, and it’s a game-changer for small businesses, manufacturers, and innovators navigating a challenging economic landscape shaped by trade pressures and global uncertainty. Whether you’re in shipbuilding, clean tech, or advanced manufacturing, this year’s budget could open the door to funding that helps your business grow.

Let’s break it down in plain terms, with a clear takeaway: now is the time to check your eligibility for grant funding, and we’ve got the tool to help you do just that.

A Bigger Budget (and a Bigger Deficit)

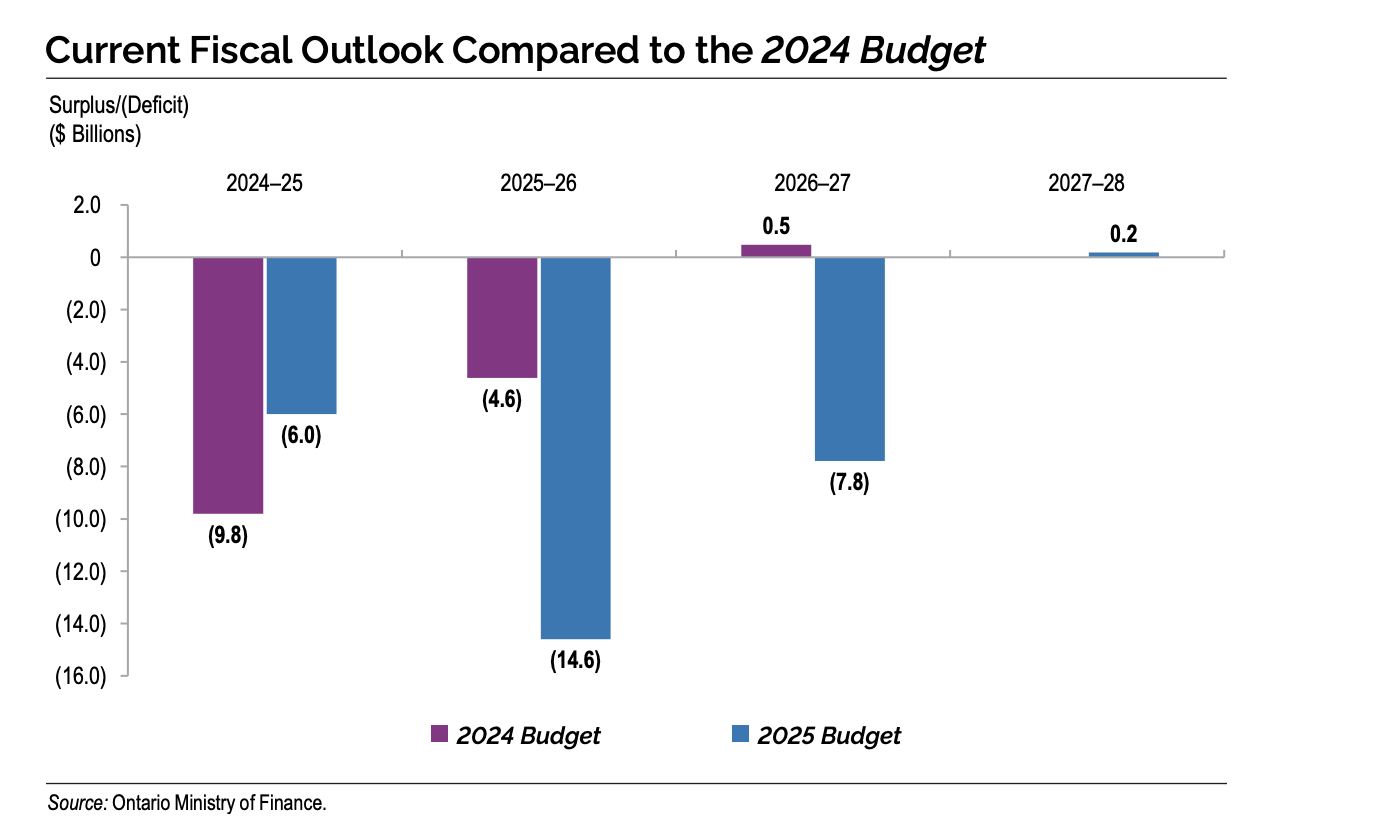

- Deficit in 2024: $6.0 billion

- Deficit in 2025: $14.6 billion

Despite the climb in deficit, Ontario is making strategic investments to shield local businesses from the ripple effects of global trade disruptions, especially those caused by U.S. tariffs.

| Aspect | 2024 Budget | 2025 Budget |

| Deficit Projection | $6.0 billion | $14.6 billion |

| Economic Focus | Infrastructure and housing investments | Counteracting trade impacts, supporting manufacturing, and promoting economic resilience |

| New Grant Programs | Limited introduction of new grants | Introduction of multiple targeted grant programs addressing trade disruptions and industry support |

| Tax Measures | No new taxes or increases | Temporary increase in manufacturing tax credit and expanded eligibility |

What’s New? Grant Programs You Should Know About

This year’s budget introduces a suite of new and expanded grant programs worth billions:

Protecting Ontario Account – $5B

Emergency relief for businesses impacted by U.S. tariffs. Think of this as a safety net when all other funding options are exhausted.

Ontario Shipbuilding Grant Program – $200M

Designed to revive Ontario’s marine industry. If you’re in shipbuilding or marine services, this is one to watch.

Trade-Impacted Communities Program (TICP) – $40M

Supports communities and local businesses hit hard by international trade challenges, helping them pivot to domestic supply chains.

Ontario Together Trade Fund – $50M

Focused on helping businesses innovate and stay competitive under new trade realities.

Skills Development Fund – $1B over 3 years

Includes:

- $50M for fast-track reskilling under Better Jobs Ontario

- $20M for new training centres

Venture Ontario Expansion – $90M

For startups and scale-ups, with a focus on:

- Biomanufacturing

- AI

- Cybersecurity

- Life sciences

Who Benefits?

If you’re in one of these sectors, this year’s budget is tailor-made for you:

- Manufacturing & Processing

- Enhanced tax credits and equipment grants to modernize operations.

- Clean Energy & Critical Minerals

- Access to the new $500M Critical Minerals Processing Fund.

- Energy Efficiency

- Part of a historic $10.9B investment to reduce energy use and emissions.

- Indigenous & Regional Development

- The $3B Indigenous Opportunities Financing Program (IOFP) supports equity participation in infrastructure and energy projects.

- Technology & Innovation

- From AI to life sciences, Ontario is pushing hard on tech-driven growth.

- Tax Breaks That Work With Your Grants

- Ontario is also sweetening the deal with tax measures that pair nicely with grant funding:

Ontario Made Manufacturing Investment Tax Credit (OMMITC)

- Increased from 10% to 15%

- Now includes non-CCPCs and publicly traded companies

- Covers up to $20 million in annual investment

Shortline Railway Investment Tax Credit

- 50% refundable tax credit for infrastructure repairs

- Great for logistics, transport, and freight companies

Expanded Beer Tax Credit

- Updated to reflect new rates

- Expanded eligibility for more small brewers

$9B in Tax Deferrals

- For ~80,000 businesses, easing liquidity concerns.

What Should Businesses Do Now?

1. Check Your Eligibility

Each grant has its own rules. Start by understanding where your business fits.

2. Plan Your Projects

Whether you’re modernizing your factory or building clean tech solutions, a solid proposal is essential.

3. Track Application Deadlines

Some of these grants will roll out in waves. Don’t miss your window.

Use Our Grant Calculator

Want a quick idea of how much funding you could qualify for? Use our Grant Calculator today, it’s the fastest way to uncover opportunities tailored to your business.

Final Thoughts

This year’s Ontario budget is built for resilience. It’s about helping businesses like yours weather the storm, adapt to change, and grow stronger. If you’re ready to tap into the billions available in funding and tax support, now is the time to act. Still have questions about which grant fits your business best? Take the first step by using the Grant Calculator, and based on your results, we will have a dedicated consultant reach out to you!